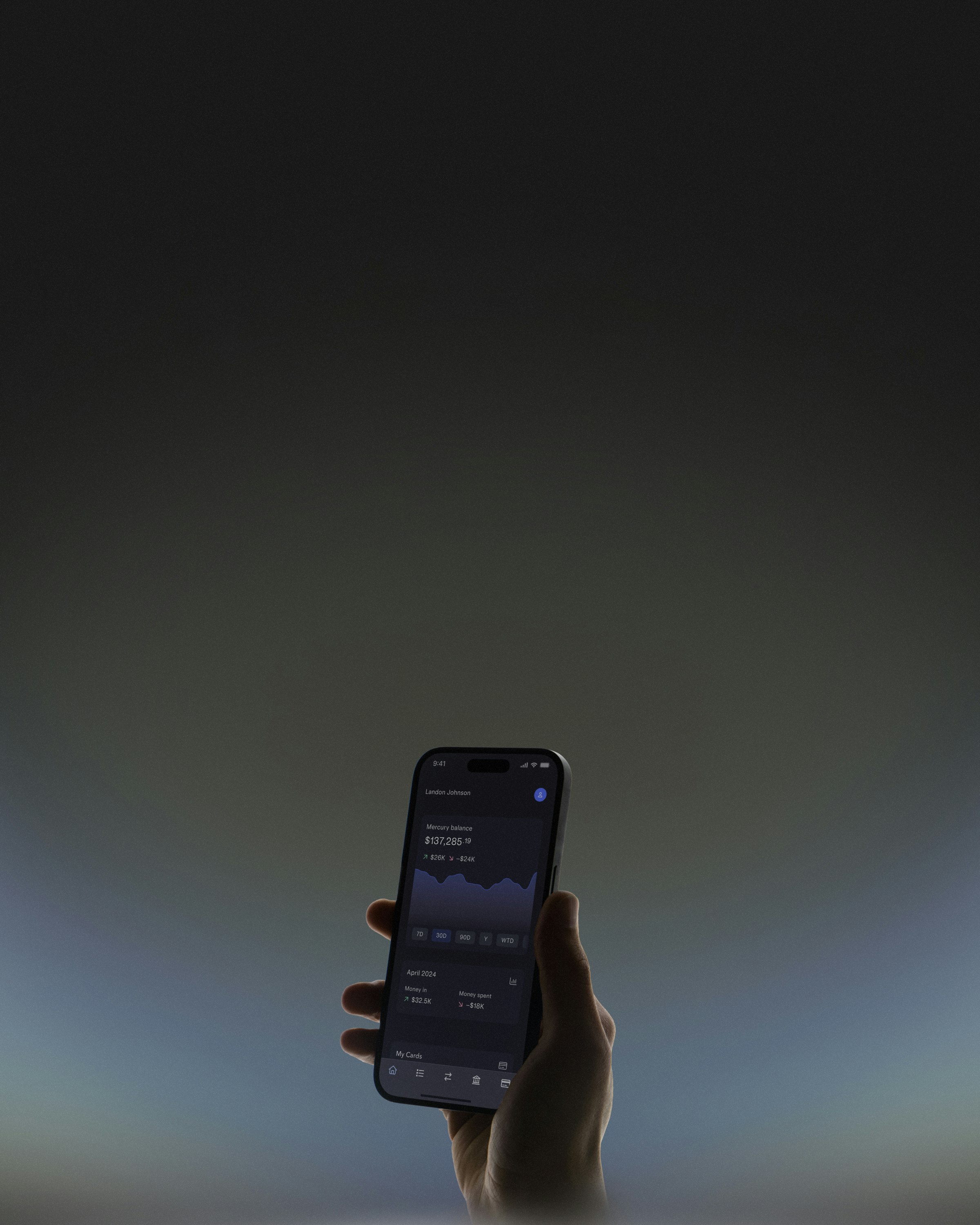

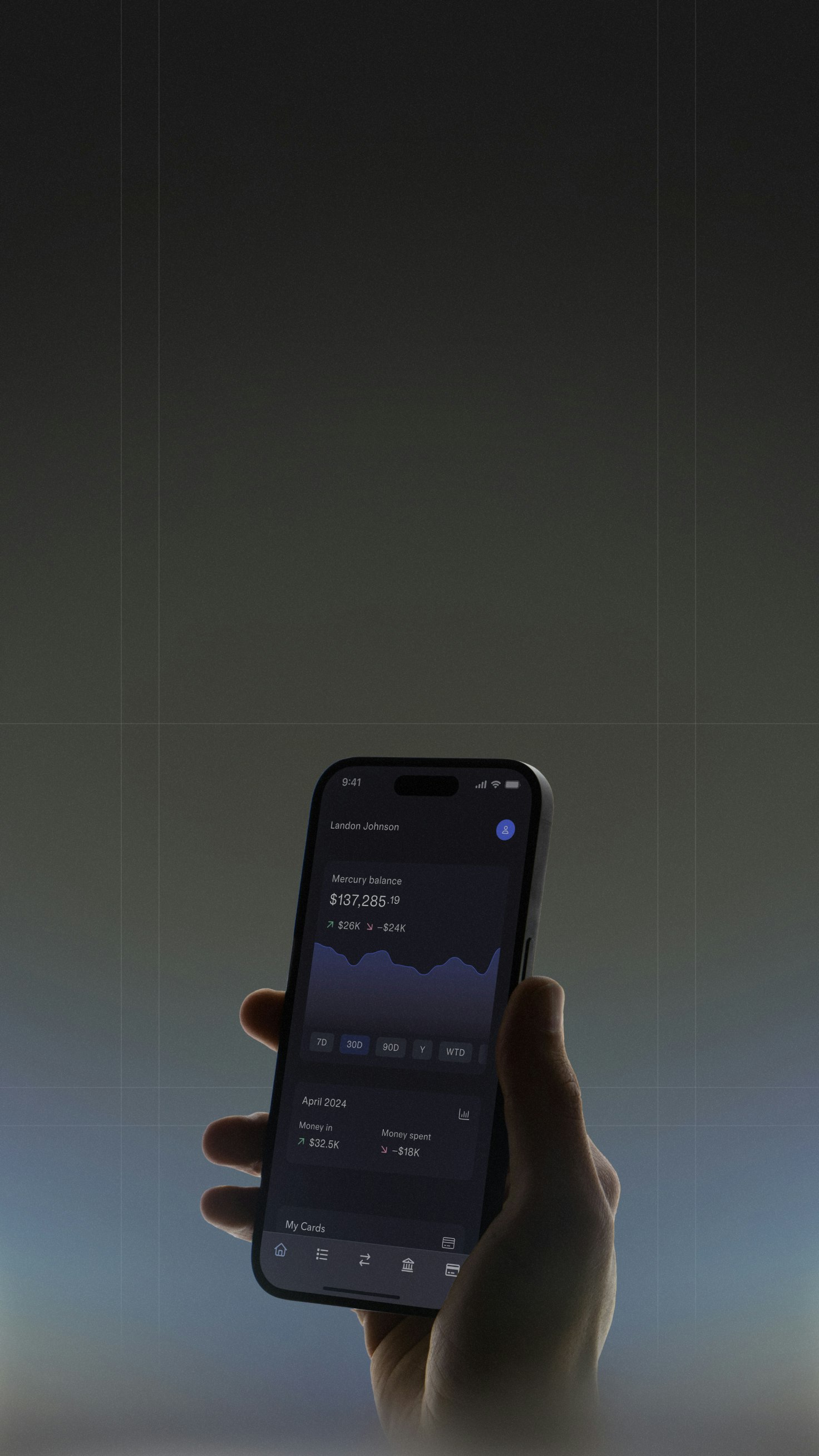

The Mercury Personal waitlist is open

Powerful personal banking for one all-inclusive subscription of $240/year.

Mercury is a financial technology company, not a bank. Banking services provided by Choice Financial Group; Member FDIC.

One subscription, endless ways to optimize your money

Never miss an opportunity to grow with high-yield savings accounts with no minimum balance.

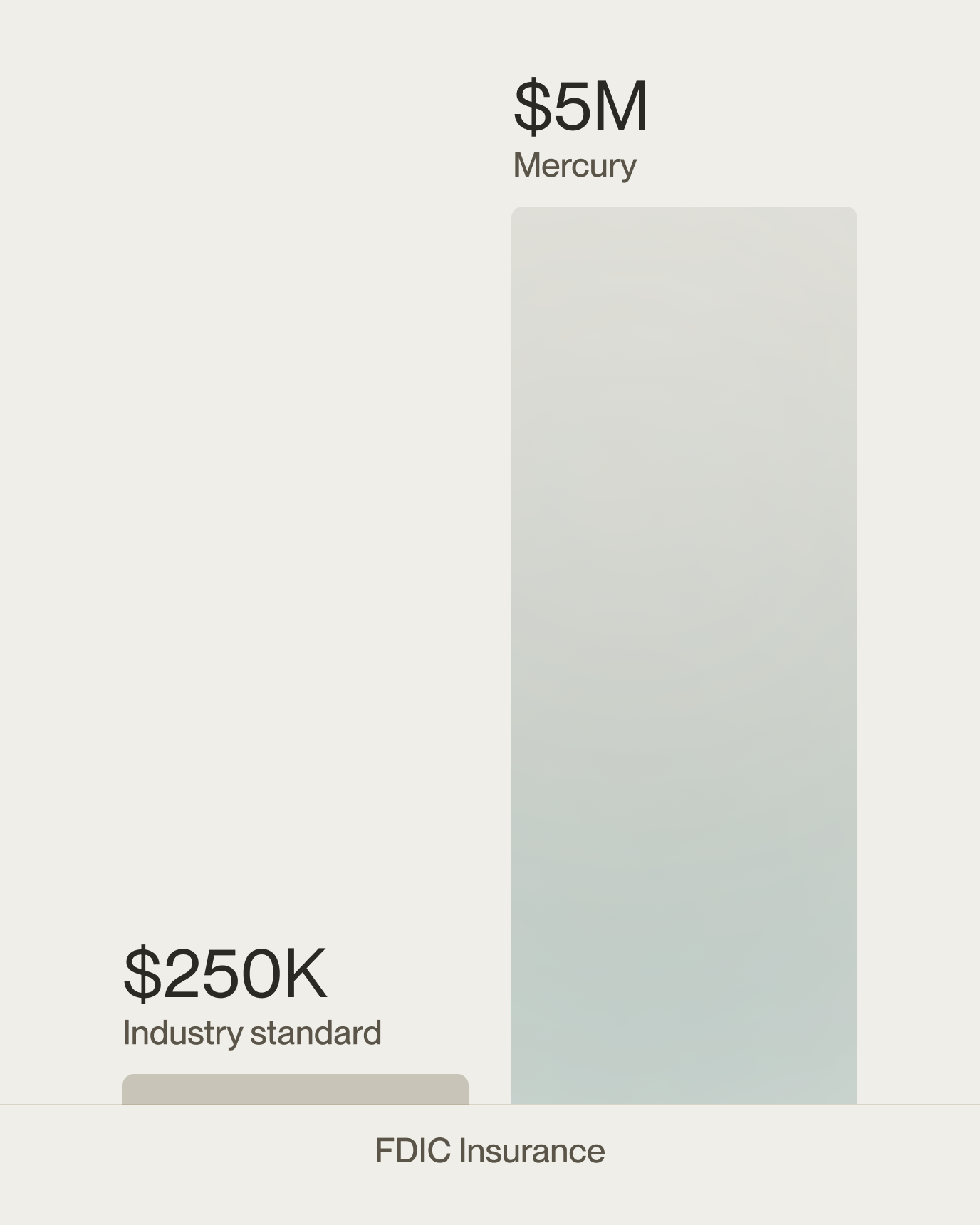

Your money is safe with expanded protection through our partner bank and their sweep network.

Send no-fee domestic wires, set auto-transfer rules, drag-and-drop bills, and tackle tasks in no time.

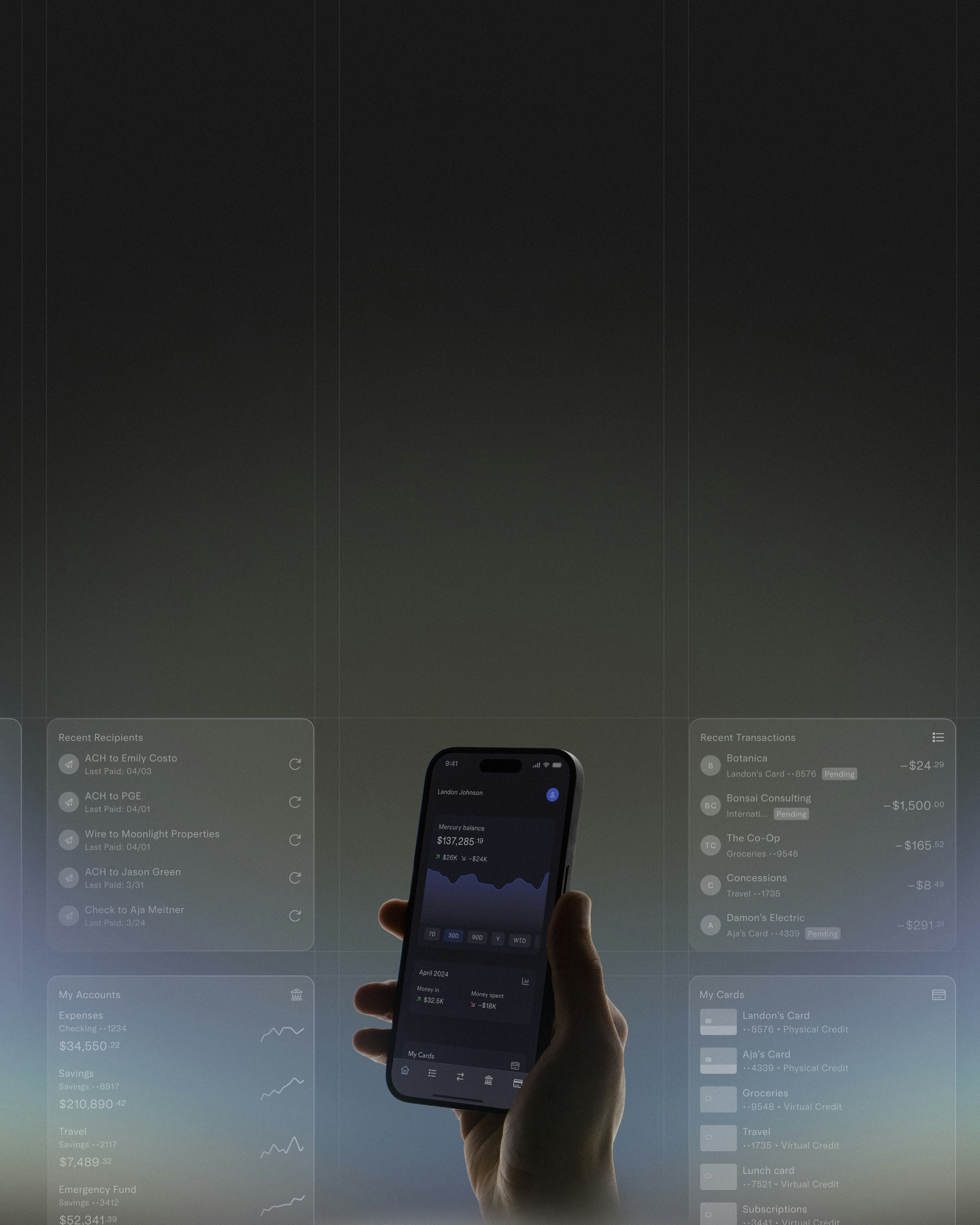

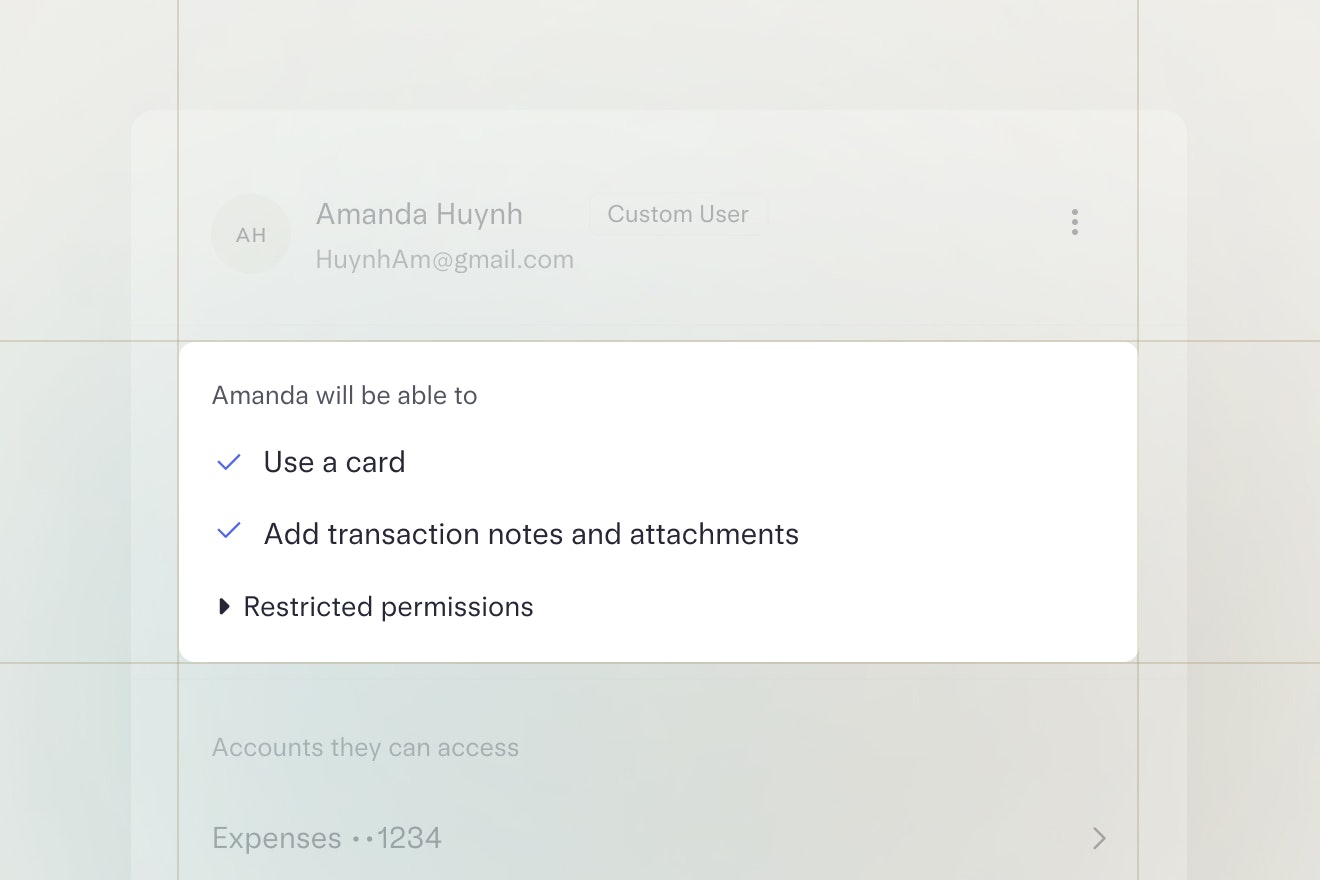

Share access with anyone

Create multiple accounts for your family, team, and financial advisor with custom permissions.

Your financial operating system just got an upgrade

Make money moves without manual tasks

- Create an account for every goal or expense

- Set auto-transfer rules between accounts

- Send no-fee domestic wires in seconds

- Drag-and-drop bills to pay them in a click

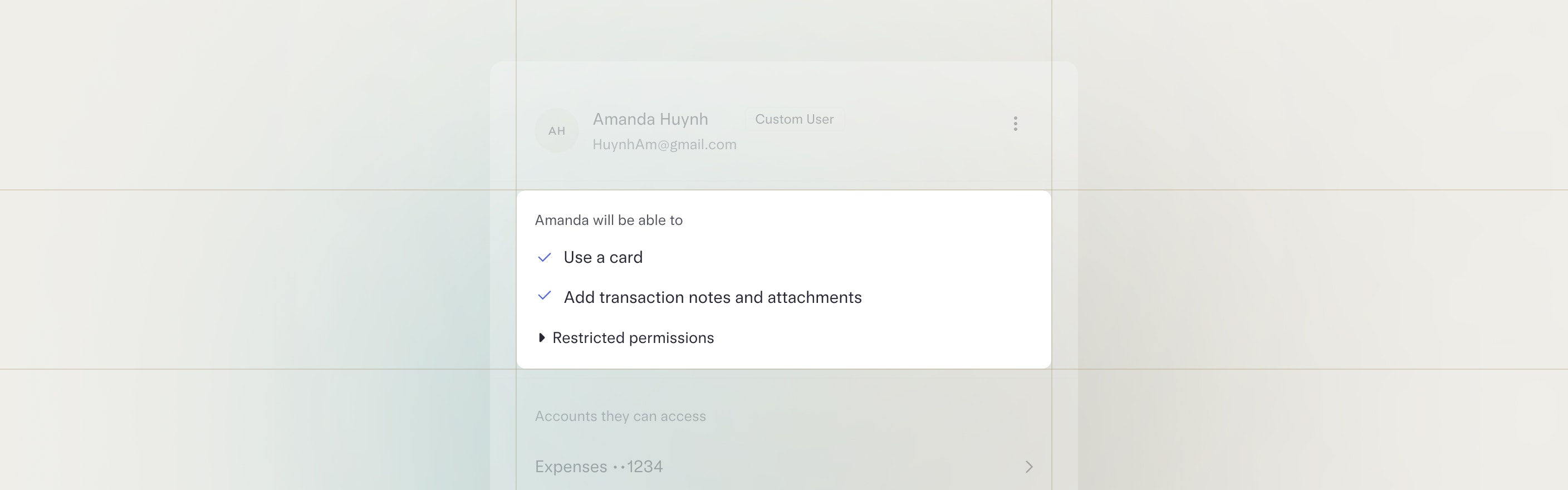

Room for everyone in your life

Custom accounts for your family and team

Add additional users with custom permissions for your spouse, personal assistant, financial advisor, or anyone who needs access.

$240 annually, $0 in surprise fees

Fine-tune your finances without minimums or hidden fees with a single annual subscription.

- IncludedUnlimited no-fee domestic wires, ACH, and check payments

- IncludedMultiple checking and savings accounts

- Coming soonJoint accounts

- Coming soonInternational wires

How Mercury Personal stacks up

Mercury Personal is so different from the traditional alternatives — it's in a class of its own. It’s fast and easy to send wires for investments, the APY I earn is fantastic, and I’ve enjoyed the granular permissions for giving a loved one access to the account.

Rajiv Ayyangar

CEO

Product Hunt

Content

Mercury Personal has already seamlessly integrated into my life. It is nothing short of revolutionary for consumer accounts, which have long felt disconnected from the tech sector’s pace and innovation. It has the seemingly simple and magical features that have always set Mercury above the rest.

Shane Mac

Co-founder & CEO

XMTP

Web3

Huge fan of Mercury Personal. Top-notch user interface. Unlimited wires. Reimbursed ATM fees. Plus, a high-yield savings account. It's the account I've been dreaming of for my personal finances.

Ethan Bloch

Founder & CEO

Digit

Fintech

Mercury is the new gold standard for personal accounts. I love that wire payments are included and I can create interest-bearing sub-accounts to set money aside for capital calls, taxes, etc. The experience is already beyond any other product out there — and it's only getting better!

Jake Zeller

Founder

Powerset

Venture Capital

Frequently asked questions

- Require HTTPS on all pages, and use HSTS to ensure browsers only ever connect to Mercury over a secure connection.

- Employ a third party to perform penetration testing each year to check for vulnerabilities.

- Hash and store all passwords with the bcrypt algorithm — never as plaintext.

- Use time-based one-time passwords for two-factor authentication. We never send authentication codes via insecure channels like SMS.

- Encrypt our database and all uploaded images, with additional encryption for sensitive data like social security numbers.

- Never store your debit or credit card numbers.

Join the waitlist

Spots in Mercury Personal are limited at launch. Sign up to add your name to the list and be one of the first to experience the future of personal banking.